How Do Student Loans Work?

FINANCIAL AID | 4 MIN READ

Taking out a loan to pay for college can be a scary prospect. After all, who wants to start their adult life bogged down in debt?

But if you look at the loan as an investment in your future—and borrow wisely—a college loan becomes a realistic and manageable tool to help you hit your educational and career goals. And you’ll be in good company: 40 million Americans have student loans.

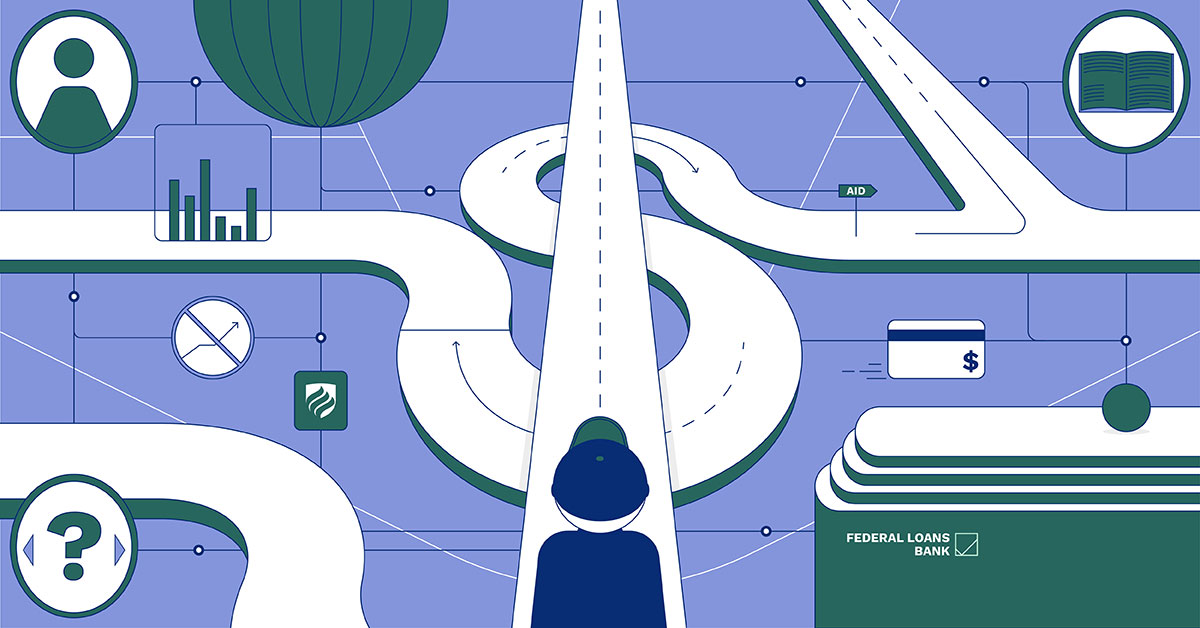

Keep in mind, also, that you have multiple ways to pay for college. Before you look at loans, see if you qualify for scholarships or grants, which don’t have to be repaid. A high school counselor or college admissions office can help point you in the right direction.

Step 2: Investigate federal loans. Federal loans have many benefits over loans from private lenders, so you’ll want to see how much you can cover with these packages. Fill out a Free Application for Federal Student Aid (FAFSA), which will determine how much you can borrow. Depending on your status and your grade level, you may be eligible for between $5,500 and $12,500 a year.

Federal Loan Basics

The U.S. Department of Education offers a Direct Loan Program, with four types of loans:

- Direct Subsidized Student Loans: These loans for undergraduate students are based on financial need.

- Direct Unsubsidized Student Loans: Eligibility is not based on need.

- Direct PLUS Loans: These loans go to graduate or professional students, or to the parents of dependent undergrads. They are not based on need and require a credit-based application.

- Direct Consolidated Loans: Once you complete school, this program allows you to combine your existing eligible federal loans with one loan servicer.

The interest rates for federal loans are fixed and determined each year by Congress. The interest rate almost always comes in lower than the ones offered by private lenders, and they definitely will be lower than those for credit cards.

Other Benefits of Federal Loans

- The interest is tax-deductible.

- Most don’t require a credit check or co-signer.

- You won’t have to start repaying until you graduate, leave school or drop below full-time status; most also give a grace period for the first six months after you graduate before you have to start payments.

- Loan repayment deferrals are available.

- If you go into certain professional fields, a portion of your federal loan may be forgiven.

Private Loan Basics

Private loans offer another option to piece together the money you will need for higher education. Knowing what’s available to you will help fill in the larger picture of how student loans work.

Private loans have a separate application process than federal loans. Interest rates are determined by the lender you choose. That rate might be fixed (meaning it doesn’t change) or variable (it changes with the market), so it pays to shop around.

As you look around, take a minute to compare the terms of different private loans. And don’t limit your research to the internet: You can reach out to a college financial aid office or contact lenders directly.

Banks, credit agencies and other organizations that offer private loans determine the amount you are allowed to take out and the terms of repayment. You may have to begin paying on the loans while you are still in school, and interest is not usually tax-deductible.

How Much Money Should You Borrow for College?

That answer depends on many factors, including your own comfort level and how much of a debt burden you are willing to take on after college. Consider, also, other sources of debt you might have, like credit card bills or a car payment.

Start by calculating your living expenses while in college—and give yourself a cushion. Another rule of thumb: Try not to borrow more than your anticipated first year’s salary.

Still Need Help Figuring Out College Loans?

The Office of Student Financial Services at Elmhurst University can help. Elmhurst awards low-interest student loans from funds provided through federal programs but can also guide you through the requirements to securing loans on your own. Reach out to us using the form below!